All That Glitters is Gold Indeed

Indians are renowned for their propensity to save. The saving rate i.e., savings as a percentage of Gross Domestic Product (GDP) in India has been as high as 35 percent in 2009-10. Since then, it has declined to 29.90 percent as of 31 March 2020 and further to 28.20 percent as of 31 March 2021 (Statista, 2021). Nonetheless, it is still reckoned amongst the highest in the world.

Most savings get channeled as investment opportunities ranging from the riskiest to the least risky. Most small investors are risk-averse and prefer to invest in the least risky and tax-saving instruments rather than the riskier ones. Smart investors seek a tradeoff between risk and return.

Depending on their preference, they could choose to invest in fixed income investments (bank deposits, small savings instruments, government bonds, corporate bonds, fixed deposits, debentures, debt mutual funds, etc.), real estate (land, residential property, and commercial property), equity shares (direct investments and mutual funds), insurance products and bullion (gold, silver, precious metals and stones).

Also Read: The Indian Economy: Stop the Slide…Before It Slips

In a relatively affluent society with a perfectly competitive environment, all investors have access to many investment opportunities and they make their choices based on their risk appetite and investment horizon. If they can, they would also prefer to diversify their investment portfolio by adopting the strategy of asset allocation to mitigate risks associated with investment and maximize their return. They could also make their investment decision to minimize their tax liability.

Sadly, this may not be the case for the bulk of small investors as many of the investment channels may not be practically available to them. Consequently, they remain largely confined to low return and low-risk opportunities like small saving instruments and bank deposits.

Small investors and most pensioners in India have been traditionally risk-averse and have historically been investing a larger part of their investible surpluses in bank deposits and to some extent in gold, mostly in the form of jewelry. However, with increasing education, awareness, and income levels now there is a shift towards riskier assets like equity shares and mutual funds which give better returns. Relatively affluent sections of the society have, in contrast, been making investments in a diversified portfolio including gold and bullion.

Also Read: Catastrophic Consequences of the Russia-Ukraine Conflict

People in India traditionally invest in gold on various auspicious occasions, such as Dhanteras, Akshaya Tritiya, and marriages. Gold is considered a safe-haven asset and during the uncertain, turbulent, and volatile phases, money tends to flow from riskier assets to gold.

Gold and bank deposits are considered virtually risk-free and liquid. Even fixed or term deposits have provisions for pre-mature withdrawal and bank loan is also easily available against these. Similarly, gold is also considered liquid as it can be easily sold if required. Gold loan is also amply available from banks and Non-Banking Finance Companies (NBFCs).

Rural people and farmer folks purchase gold during times of good income. This helps them tide over the bad times. People in India traditionally invest in gold on various auspicious occasions, such as Dhanteras, Akshaya Tritiya, and marriages. Globally also, gold is considered a safe-haven asset and during the uncertain, turbulent, and volatile phases, money tends to flow from riskier assets to gold.

Also Read: A Tax-Free Economy to Tackle the Menace of Black Money?

This article evaluates the relative merits and demerits of investment in bank deposits and in gold. In the bank deposit, we have taken the fixed deposits which constitute a major chunk of the deposits portfolio of banks as well as investors. As regards gold, we have considered bullion (bricks, bars, coins, etc.) and not ornaments as these are predominantly held for consumption purposes. We have not considered Sovereign Gold Bonds and Gold Mutual Funds as these are recent phenomena and are yet to pick up.

The Bank Fixed Deposits carry the reinvestment risk. The rate of interest varies according to the size and tenor (7 days to 10 years) of deposits as also the category of the depositor (senior citizens generally get additional interest). It is dependent on the rate of inflation, liquidity position in the economy, and off-take of bank credit and is generally guided by the policy rates of the Reserve Bank of India (RBI).

The recent hike of 40 basis points in Repo Rate by the RBI is expected to lead to rate transmission, both for deposits as well as advances, and the increase in interest rates on deposits will benefit depositors.

The recent hike of 50 basis points in Repo Rate by the RBI is expected to lead to rate transmission, both for deposits as well as advances, and the increase in interest rates on deposits will benefit depositors. The interest on bank deposits is taxable and the real return is actually less and often considered to be negative if the rate of inflation is more than the post-tax return.

The Gold rates, on the other hand, tend to be volatile and dependent on the demand and supply position and currency exchange rate. It is guided by global prices. Incidentally, India is the second-largest consumer of Gold in the world, after China (Wadhwa, 2022). India is also the largest importer of Gold (Singh, 2021). The income derived from the sale of Gold is subject to Capital Gains Tax. Purchase of Gold now attracts Goods and Services Tax (GST) which, however, has been ignored as it was not applicable 20 years ago.

Also Read: The Great Indian Economy: Ravaged by COVID-19, Ruined by Petroleum Prices and Policies:

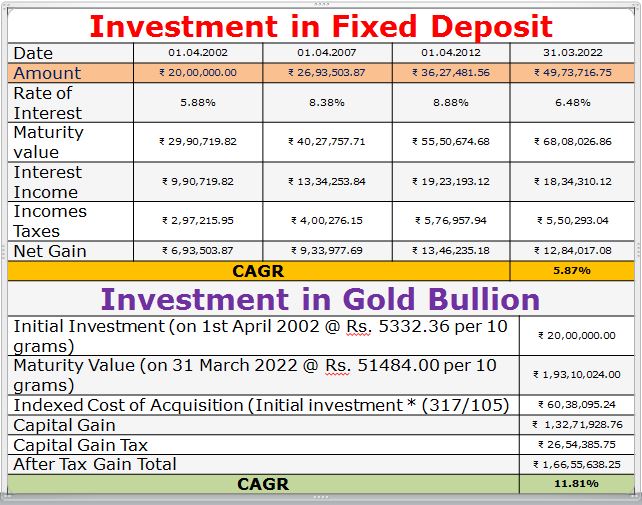

The article specifically focuses on ascertaining as to which these forms of investments offer higher returns to an investor over a longer period of time. The analysis covers a time horizon of 20 years (1st April 2002 to 31st March 2022). Further, the Fixed Deposit is made for a maturity of 5 years and renewed on maturity at the prevailing rate of interest compounded annually. In the case of Gold, a one-time investment has been considered to be liquidated after 20 years. To simplify the calculation, an investment of Rs. 20.00 Lakh either in the Fixed Deposit or in Gold has been considered. The Computations are shown below.

Findings and Conclusion:

The prevailing rate of interest on fixed deposits for a maturity period is found to be 5.88, 8.38, 8.88, and 6.48 percent as on 1st April of 2002, 2007, 2012, and 2022, respectively. It is assumed that the investor has been in the highest tax bracket, which during the period was 30 percent, and that the investor paid Income Taxes out of his other savings rather than by way of deduction out of the maturity value.

Investment in Gold fetches far better returns than investment in fixed deposits.

Based on the above rates and assumptions, the computation shows that an investment of Rs.20.00 Lakh in the Fixed Deposit made on 1 April 2002 would mature to Rs. 86.65 Lakh as of 31 March 2022. The After-Tax CAGR works out to be 5.87 percent.

During the period under investigation, the average Gold prices in 2002 were Rs. 5332.36 per 10 grams which rose up to Rs. 51484.00 per 10 grams. Thus, an investment of Rs. 20.00 Lakh in Gold bullion in 2022 would become worth Rs. 193.10 Lakh.

Also Read: Transparent Taxation – Honouring the Honest: An Introspection

Since such gains are treated as a long-term capital gain presently taxed at the rate of 20 percent based on the indexed cost of acquisition, the investment would result in an After-Tax CAGR of 11.81 percent.

It is thus established that investment in Gold bullion fetches a far higher return than the Fixed Deposits pre-tax as well as post-tax. Hence all that glitters is indeed gold!

References:

- Singh, A. (2021, October 17). India’s gold import jumps 252% in April-September period since a year ago | Deccan Herald. https://www.deccanherald.com/business/business-news/india-s-gold-import-jumps-252-in-april-september-period-since-a-year-ago-1041550.html

- Statista. (2021). • India: gross domestic savings rate 2021 | Statista. https://www.statista.com/statistics/1013572/india-gross-domestic-savings-rate/

- Wadhwa, P. (2022, April 11). Gold consumption highest among Indian middle-income group | Business Standard News. https://www.business-standard.com/article/markets/gold-consumption-highest-among-indian-middle-income-group-122041100455_1.html

- BankBazaar. (n.d.). SBI FD Rates April 2022 | Revised Fixed Deposit Interest Rates. Retrieved May 6, 2022, from https://www.bankbazaar.com/fixed-deposit/sbi-fixed-deposit-rate.html

- RBI. (2021). Reserve Bank of India – Handbook of Statistics on Indian Economy. https://www.rbi.org.in/scripts/AnnualPublications.aspx?head=Handbook of Statistics on Indian Economy

- Taxguru. (n.d.). Gold and Silver rates as on 01.04.1981 & From 31.03.2022. Retrieved May 6, 2022, from https://taxguru.in/income-tax/gold-silver-rates-urrent-ten-assessment-years-april-1-1981.html

Disclaimer: The views expressed in this article are of the authors solely. TheRise.co.in neither endorses nor is responsible for them.