The recent IPO of Zomato is just one case in the larger canvass of the Indian startups going public. Another Indian startup, Paytm, is eyeing the largest Indian IPO of Rs. 16,600 crore. However, India’s startup ecosystem is lagging behind in terms of the conversion rate of startups into unicorns. Here, we analyse the internal and external factors that play role in the survival of start-ups in India, the various government policies in place for providing them with a supportive environment, the reasons for the failure of Indian startups and required measures to ensure their viability in the long run.

For a seed to grow into a plant, a number of internal and external factors are at play. The same is the case of a start-up growing slowly into a viable enterprise and then later growing to a Unicorn or Decacorn. The external factors for the development of a start-up consist of the support system. In India, the government, although late, has woken up to understand that Indian economic problems need innovative solutions. In the last few years, the government has done quite a bit to spur an environment of entrepreneurship and established systems to handhold the budding entrepreneurs.

‘Ease of doing business’ rank of India jumped from 79 in 2014 to 63rd in 2020 among a list of 190 nations, [1]. The ‘ease of doing business’ ranking is based on 10 parameters such as starting a business, dealing with construction permits, getting electricity, registering property, getting credit, protecting minority investors, paying taxes, etc. It is the aggressive policy changes of the government that has brought about this change.

Schemes promoting entrepreneurship in India

Since 2014, steps have been taken in several directions starting from the current requirements of entrepreneurs to fostering an environment and creating innovation & entrepreneurship-inclined youngsters for tomorrow. Umbrella schemes like Atal Innovation Mission (AIM) create a culture of innovation and entrepreneurship across schools, universities, research institutes, and various other welfare bodies at the national, state, and district levels. Under this program a number of specialised cells have been created like:

- Atal Tinkering Labs at schools for developing a problem-solving mind-set of the students

- Atal Incubation Centres for supporting start-ups in universities and institutions. Till now, IITs and NITs have been at the forefront of developing new ventures. These incubation centres aim at developing the same opportunities at every university & institute by funding the selected start-ups to the tune of 10 crores over a period of 5 years.

- Atal Community Innovation Centre which have been established to develop community centric innovation and ideas in Tier 2 and 3 towns.

- ARISE programme focussed on innovation and research in the MSME industry.

- Mentors of Change Mentor India Network with field experts from industry and academia to support the start-ups.

- Country Partnerships in various areas to foster innovation in the country.

Another programme, the Pradhan Mantri Mudra Yojana with its comparatively flexible lending norms and zero collateral up to 10 lakh rupees, has been launched by the Government across the entire banking where enterprises can avail loans from banks depending on their requirement under 3 categories: Shishu, Kishor and Tarun loans. A few other programmes that aim at strengthening the base of Women entrepreneurs and people with humble backgrounds are the Women Entrepreneurship Platform (WEP) and Self Employment Lending Schemes Credit Lines (for NGOs and Self-help groups). Then there are sectoral programmes ranging from the NewGEN IEDC programme by the Entrepreneurship Development Institute of India promoting knowledge-based technology start-ups, MSME focussed Market development assistance programme, Venture Capital Scheme for Agribusiness Development and Sustainable Finance Scheme promoting sustainable development projects, [2].

However, despite the efforts of the government, why are the start-ups still facing challenges?

Also Read: Understanding Indian Startup Ecosystem

90% of Indian startups fail within first five years!

We all have heard of Vijay Shekhar Sharma of Paytm and the Bansal brothers of Flipkart. But little news flows around the dooms of start-ups like Stayzilla, Overcart, Doodhawala etc. It all looks glorious to start a venture when the adrenaline rush is high but little is known about the focus that successful entrepreneurs develop and the toil they go through.

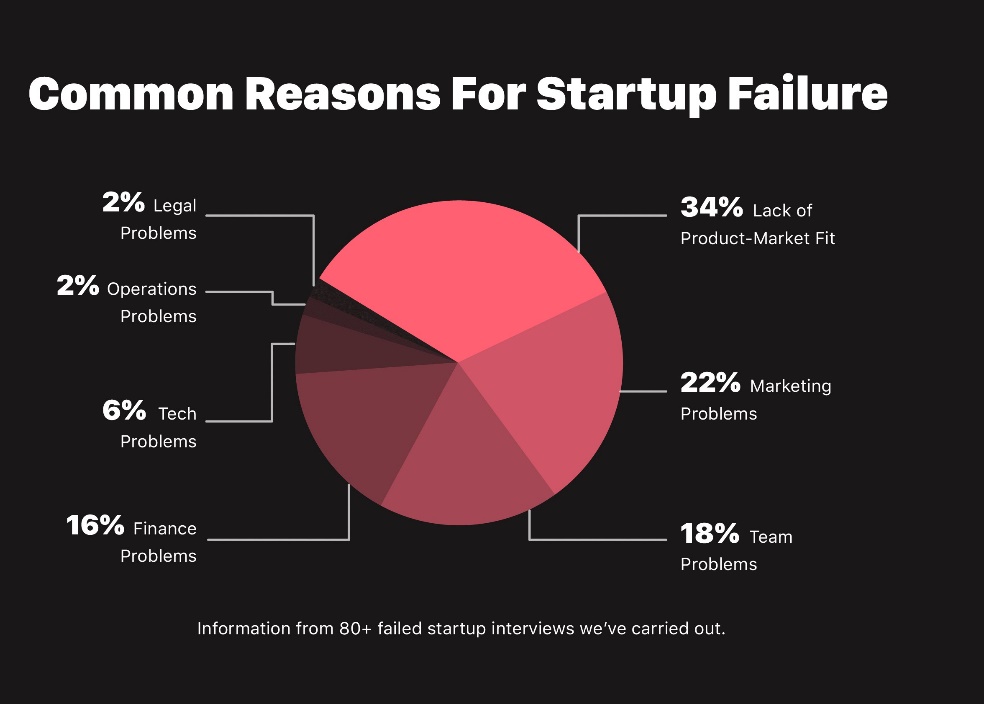

Although there are a lot of start-ups doing exceptionally good in the country, IBM Institute for Business Value and Oxford Economics states that 90% of Indian start-ups fail within the first five years and the major reason has been lack of innovation, [3]. A major factor that has been observed in many studies is that the Indian entrepreneur is risk-averse. This is also due to societal concerns of a venture turning to failure or fewer income prospects in the initial years due to which many times the entrepreneurs get spooked to continue.

Although the government has been trying to push innovation through its various programmes, sadly the key element missing from the implementation of all these schemes is innovation itself. Many start-ups have copied the business models of companies overseas and have tried implementing the same in India even when it didn’t suit the Indian landscape. Indian market is saturated with common services. What we need is disruption and innovative ways to deliver the same services again.

The basic marketing concept demands evaluation of 4Ps: Product, Place, Price and Promotion. Product i.e. the demand of the product to cater to the market in the long term, the margin viability refers to the price, the target market & distribution channel refer to the place, and the marketing strategies refer to the promotional aspect. If one is offering services then s/he can add people, processes and physical components to the offerings.

Also Read: Indian Startup Ecosystem Third Largest, Behind China & US: A Comparison of Three Growth Engines

Although you don’t need to essentially go to a business school to learn this as there are tons of people who have made successful business stories without the basic formal education too, a little careful planning, long term vision, information gathering and assessment will help one to understand the various reasons of failure mentioned above and avoid them. There are tons of marketing companies that specialize in helping start-ups in developing marketing channels and disrupt the market. However, due to the risk-averse nature of the entrepreneurs, they hesitate to spend on such professional services.

Many start-ups have copied the business models of companies overseas and have tried implementing the same in India even when it didn’t suit the Indian landscape. What we need is disruption and innovative ways to deliver the same services again.

Apart from the quantitative factors above, there are several qualitative challenges faced by the start-ups in the Indian market. The first one being that the Indian market is largely unorganized with demands and customer expectations changing every few hundred kilometres. Thus, the start-ups find it challenging to find a product to cater to a market. Secondly, the concept of entrepreneurship is still not much appreciated in India. The Indian parent would still prefer his child to work for a company than to start a new venture. In Indian society, individuals still keep the option of working for a start-up as the last resort. This makes the talent pool available scarce and the ones which are available are too costly to afford.

Another challenge is funding. The banks and other financial institutions are still hesitant to lend to start-ups. Even the institutions set up by the government cater only to a handful of start-ups. Although there are venture capitals and angel investors, the ratio of capital available to the number of start-ups that require the funds is pessimistically low. This has led to a lot of start-ups closing their doors because of funding-related issues. Also, talking about funding, how can we forget about the complexity of taxation, filing patents and the regulatory compliances for any business. According to the report of World Intellectual Property Indicators 2020, India is way behind in filing patents than its Asian counterparts, [4].

The unfriendly exit policies of Indian startup ecosystem also contribute to the hesitation of investors to jump into the Indian ecosystem. Investors risk their capital and invest in start-ups expecting some return at the end in addition to capital repayment. This is why start-ups need to have an exit strategy. There are multiple ways through which a start-up can exit an ecosystem. It can either sell itself to a bigger company (Walmart acquiring Flipkart in 2018 for $16 billion) or can roll out an IPO (Makemytrip getting listed on NASDAQ in 2010). In addition to benefitting the angels and VCs, an exit strategy also makes sure that a circular flow of this capital is maintained in the ecosystem and these investors help newer start-ups grow.

The unorganized nature of Indian market, poor social acceptance of entrepreneurship, lack of funds availability, complex regulatory compliances, and exit-related issues are few of the several reasons hindering India’s startup trajectory.

In India, however, exits like that of Flipkart or Yatra are outliers because of tedious regulations. According to Avinash Raghava, co-founder of iSpirit, exits through IPOs are very difficult for start-ups which is why so many of them relocate outside the country. Other ways to exit, like liquidation can take upwards of a year to be carried out along with hefty charges if the start-up possesses large assets. Furthermore, companies without any assets like internet websites cannot conform to any provision since there does not exist any dedicated policy specifically for them. Mandates like a no-objection certificate from vendors and excruciatingly long court hearings only complicate the entire process even further and most entrepreneurs opt to run have their businesses show as running on paper since it is easier than going through the ordeal of closing it down.

Also Read: Indian Startups Leading The Way in COVID-19

But, the exit ecosystem is not entirely grim in India. While India’s ecosystem may not be as mature and developed as that of the US, constant improvements over the years have helped Indian start-ups exit. In April 2021, Zomato filed a draft prospectus with SEBI for its IPO. Flipkart is planning to roll out its IPO in the United States in 2022 through a Special Purpose Acquisition Company (SPAC). Start-ups like Delhivery, Nykaa, Policybazaar are also preparing for going public in 2021. SEBI in 2019 introduced the Innovators Growth Platform (IGP), a separate exchange for new-age start-ups and eased the eligibility and listing criteria to boost public start-up funding.

In short, we are still a long way from providing a favourable environment to start-ups for turning into profitable and successful ventures. The solution lies not in creating more programmes by the government to create more defunct and bureaucratic bodies but to create an easy working environment for entrepreneurs which creates hassle-free funding and mentoring facilities for the start-ups. In addition to this, a stable political environment, support for filing patents and the practice of avoiding abrupt policy changes/reversals will instil investor confidence and attract more foreign investors.

References

- The Economic Times – India jumps to 63rd position in World Bank’s Ease of Doing Business 2020, https://economictimes.indiatimes.com/news/economy/indicators/india-jumps-to-63rd-position-in-world-banks-doing-business-2020-report/articleshow/71731589.cms

- The Better India – Government schemes every entrepreneur should know https://www.thebetterindia.com/219696/india-government-schemes-entrepreneurs-start-up-women-ngo-msme-funding-gop94/

- Money Control, July 09, 2018 – 90% Indian start-ups fail within 5 years of inception https://www.moneycontrol.com/news/business/90-indian-startups-fail-within-5-years-of-inception-study-2689671.html

- World Intellectual Property Indicators 2020 https://www.wipo.int/edocs/pubdocs/en/wipo_pub_941_2020.pdf

- Indian Start-ups: Analysing Their Vulnerabilities and Prevailing Challenges- Article by Ritesh Dwivedi, August 2020.

- Start-up India- Opportunities and Challenge- Research by Prof. Dr Roshan S Patel, Volume II, Issue I, ISSN: 2581-5628

- Challenges and Issues Faced by Start-up Companies in India – Research by Sarika Sharma, Mrinal Raj, Tanya Gandhi, ISBN: 978-1-943295-11-1