Understanding Indian Startup Ecosystem

This article closely analyses the Indian start-up ecosystem and how these start-ups are distributed throughout the states of the country. It further observes which sectors see the most rush of new start-ups and what are the reasons why start-ups prefer some states over others. Lastly, it throws light on the sources of investments these start-ups receive and how this picture is also changing amidst an increase in tensions with neighbouring China.

Start-up culture has been on the rise in India and the addition of twelve new unicorn start-ups (businesses that are less than 10 years old with a valuation greater than or equal to $1 billion) in the year 2020 has only made this ecosystem look more lucrative and viable. While the entire country adds more than a thousand start-ups annually, some states contribute more to this list than others. According to a report by Ministry of Commerce and Industry [1], five Indian states accounted for over 60% of all start-ups in India in 2020. Figure 1 gives an idea of how start-ups are distributed across the country.

Some states strive harder to nourish their start-ups and become dream destinations for entrepreneurs to set up their young businesses. The state of Karnataka, for instance, witnessed massive support from the state government in the form of Karnataka Start-up Policy. Launched in 2015 with the aim of creating over 20,000 start-ups in the state by the year 2020, it introduced a credit line worth Rs.2000 crore to enhance lending to businesses. Similarly, the state of Maharashtra formulated the Maharashtra State Innovative Start-up Policy in 2018 which promised to provide a platform for its citizens to convert their entrepreneurial aspirations into reality by developing robust infrastructure and easing the regulatory framework. All of this is over and above the benefits of the Start-up India Scheme launched by the central government in January 2016 which outlines benefits in terms of taxes and IP protection for all states in the country.

Infrastructure plays an equally important role in the development of a start-up. Better infrastructure ensures better supply chain and inventory management which businesses heavily rely upon. While infrastructure includes many aspects like renewable energy sources and water, one broad way to get an idea of a state’s prosperity is to look at its capital expenditures for the year. By definition, capital expenditures are incurred to create assets like roads, buildings and airports. As per RBI’s report of state-wise capital expenditure for the year 2018-19 [2], Uttar Pradesh spent Rs.968.6 billion followed by Maharashtra with Rs.629.4 billion. Unsurprisingly, both of these states constitute 27% of all the start-ups across different states. Figure 2 shows how the variables, capital expenditure and number of start-ups, are positively related for ten states with the most capital expenditure in the country.

Another factor that can completely change any business decision is the ease of doing business. Out of 29 states, 20 have their own policies for start-ups where they chalk out different relaxations that start-ups can utilize. They can be either provided relief from excess regulations or can be financially supported by subsidies. The world bank provides ranks to all states in India on the basis of their compliance with action points mentioned in the Business Reforms Action Plan (BRAP) under the ‘Make in India’ Initiative. According to the 2019 report published by RBI, UP ranked 2 in this index, Delhi 12, Maharashtra 13, Haryana 16 and Karnataka 17. Andhra Pradesh topped the list which makes it a future contender for the best location to base a start-up along with Telangana, Madhya Pradesh, Chhattisgarh and Himachal Pradesh. India was also ranked 63 in the Doing Business Report of 190 countries by the World Bank in the year 2019, a significant improvement over 142 in the year 2014.

Sectoral Distribution of Start-ups

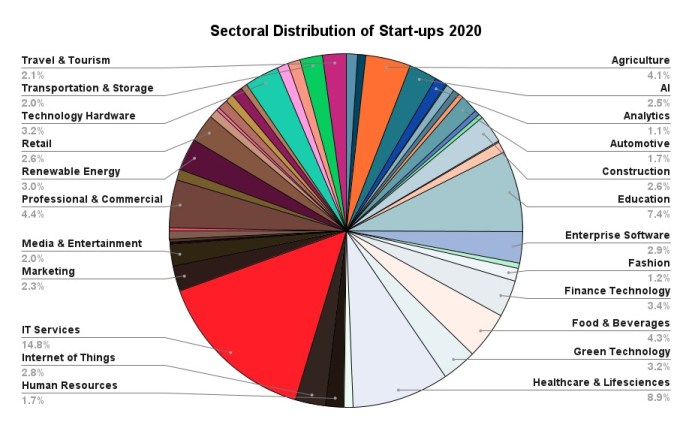

It is no surprise that India is one of the most preferred locations for setting up businesses. Highly skilled personnel and low labour costs help start-ups cut expenditures which is crucial in the early years since most start-ups rarely make profits during those times. India was the third-largest start-up market in 2020 after the US and China. Emphasis on digitalization by the government has led to the formulation of an incredible number of IT-related start-ups. As a matter of fact, over 18% of all the start-ups in India are related to deep IT services. Figure 3 is a pictorial representation of start-ups distributed in various sectors.

The Digital India campaign started by the Government of India in 2015 envisioned an impressive digital infrastructure for the country with the majority of government services to be provided online to the citizens. As per RBI [3], digital payments have seen a massive growth of over 55%. With an outlay of Rs. 3958 crores for the year 2020-21, the government is offering tremendous prospects to entrepreneurs to develop business models in the field of technology. The Ministry of Electronics and Information Technology has launched programmes like Technology Incubation and Development of Entrepreneurs (TIDE) and promotion of Electronics System Design and Manufacturing (ESDM) Skill for helping start-ups working in areas like Blockchain, Artificial Intelligence and Robotics.

Further, the development of incubators or accelerators has boosted these businesses. Incubators are usually teams of professionals with no motive to earn profits which mentor start-ups by providing them with resources like a workspace, technology and advice so that start-ups can develop their business idea. According to a report by IIM Ahmedabad [4], as of 2019, there were 13 central government ministries and departments that were supporting a total of 284 incubators in India at that time, 90% of which were established after the year 2000. 35% of these incubators were set up post-2015 which validates the effects of Startup India scheme launched in 2016.

Technology has also made its way in education with the rise in EdTech. This was profoundly seen throughout the pandemic during which India’s own Edtech unicorn, Byju’s, raised over $1.3 billion while Unacademy joined the unicorns with a valuation of over $2 billion. With work and studies having to shift online, people were less hesitant in subscribing to such platforms for their needs as compared to a time when they preferred face-to-face conversations. Byju’s free users increased from 45 million to 70 million and paid subscribers from 3.5 million to 4.7 million, clearly indicative of people adjusting to this crisis with the help of rising trust in EdTech. Two Indian cities, Bangalore and Delhi, have especially become hubs for EdTech start-ups and figure 4 is a testament to that.

Fintech has also seen a boom in India since 2015. India witnessed a 116% growth in the number of Fintech start-ups from 2014 and currently has over 2200 in total. Two Indian cities, Bangalore and Mumbai, represent 43% of the total Fintech start-ups in the country followed by Delhi, Chennai and Hyderabad. Experts say that demonetization in 2016 and the GST application provided a necessary push to digital money and indirectly helped Fintech companies to extend digital financial services to the public. Led by giants like Paytm, the sector has seen outstanding growth in the year 2020. An increase in Unified Payments Interface (UPI) paved the way for three new unicorns, namely Razorpay, Pine Labs and Digit Insurance. The future also looks very optimistic with sector valuation projected to reach $160 billion by 2025 from the current $60 billion.

Start-up Investors in India

Over the last decade, funding prospects have improved drastically for start-ups with external funding sources becoming more commonplace. In India, external funding is usually international with domestic investors contributing less as compared to countries like China and Japan where they are much more proactive. Statistically, India’s domestic investment ratio is only about 26% as compared to countries like Japan where it is as high as 84%.

One reason behind such a trend is the average investor in India being risk-averse. Since these start-ups do not prove out to be lucrative immediately, the majority of Indian investors are hesitant in blocking their money. More importantly, the capital required at this stage is enormous and thus many investors just don’t have the capacity to invest. There are also government regulations that deter domestic investors like Angel Tax which considers any capital invested into start-ups above their fair market valuation as income from other sources and taxes it. While the government has since made amendments to this system, like exempting start-ups that register with the Department for Promotion of Industry and Internal Trade (DPIIT), there are a lot of loopholes that ultimately cost start-ups dear money.

The Indian start-up ecosystem has also depended heavily upon Chinese investors. The likes of Alibaba and Tencent own shares in 18 Indian unicorns like Flipkart, Zomato and Ola. India is the second-most populous country after China and full of young professionals. Chinese investors have estimated their potential correctly in the past and have invested in a plethora of start-ups even in the younger stages as can be seen in figure 5. However, ever since the aggravation of geopolitical tensions between the two nations, Chinese investors have slowed their investments. Indian start-ups have also started looking for alternative investors so as to reduce the Chinese involvement in their companies. The Government of India has tightened its FDI norms which now make it mandatory for Chinese investments to go under government scrutiny and approval thereby further deterring these investors.

Consequently, this has opened an avenue for investors from other nations like the United States, UK, and Japan to take advantage of the freed-up market. US-based Sequoia Capital has invested heavily along with Google. Softbank, a Japanese conglomerate, is famous for its investments in Paytm ($1400 million), OYO ($100 million) and Flipkart ($2600 million). In the first 5 months of the year 2021, it injected over an estimated $2 billion in Indian tech start-ups. One reason cited for Softbank‘s heightened interest in the Indian start-up ecosystem is its massive profit ($36.99 billion) for the fourth quarter ended March 31, 2021. Constant improvement in its regulatory framework has also helped India aid its young entrepreneurs. India has been climbing the Global Innovation Index (GII) rankings and was at 48 in 2020 up from 81 in the year 2015 [5]. This further exposes the potential of Indian start-ups alluring more financial help from foreign investors. Cities like Bangalore and Delhi have also made it to the top 40 most favourable ecosystems in the world according to the Global Startup Ecosystem Report (GSER) 2020 by the California based start-up Genome [6].

References:

- Department of Promotion of Industry and International Trade, Annexure 1, https://dipp.gov.in/sites/default/files/lu2912_0.pdf

- RBI Publication dated March 3, 2019 ‘State-wise Capital Expenditure’ Table 138, https://www.rbi.org.in/Scripts/PublicationsView.aspx?id=18934

- RBI Publication ‘Assessment of the progress of digitisation from cash to electronic’, February 24, 2020, https://www.rbi.org.in/Scripts/PublicationsView.aspx?id=19417

- Supriya Sharma and Neharika Vohra, ‘Incubation in India – A Multilevel Analysis’, IIM Ahmedabad, March 2020, Page 10

- Global Innovation Index Report 2020, ‘Heatmap: GII 2020 ranking overall and by pillar’, Page 10 https://www.globalinnovationindex.org/Home

- The Global Startup Ecosystem Report – ‘Rankings 2020: Top 30+ Runners-up’, https://startupgenome.com/article/rankings-top-40

Pingback: Indian Startup Ecosystem Third Largest, Behind USA-China: A Comparison

Pingback: Indian Startups Leading The Way in COVID-19 - TheRise.co.in

Pingback: Zomato Goes Public. Yet, 90% Indian Startups Fail within 5 years. Why?